Total risk score90Critical

Collateral

7/10

What are you pledging? Native BTC is safest; wrappers, bridges, or paper IOUs add redemption risk.

BTC must cross the proprietary CrossLink MPC bridge before it can be pledged, meaning the borrower no longer holds L1 UTXOs; custody rests with an unproven cross‑chain system.

Rehypothecation

0/10

Will your BTC be re-used? More hidden leverage → bigger blow-up chance.

Platform explicitly forbids any reuse of collateral; each vault is segregated and not rehypothecated.

Custody

7/10

Who can move the coins? Scores quorum design, recovery paths, and (for CeFi) bankruptcy-remote segregation.

Libre’s Bitcoin-backed loans inherit two custody layers: (i) bridge layer—BTC locked in the CrossLink MPC-TSS quorum (captured in Collateral = 7); (ii) vault layer—the wrapped BTC that borrowers actually pledge sits in a dedicated address controlled by the same 21-validator MPC quorum. Borrowers have no unilateral exit, and no independent audit of the wallet tech or key-management stack has been published, so the DeFi ladder assigns Custody = 7, signalling a medium-to-high custody risk.

Security & Governance

7/10

How battle-tested are code and ops? Counts audits, bug-bounty, certs, and hardware key isolation.

Although the documentation references advanced cryptography, the roadmap still includes “Enhanced Security Measures: additional auditing,” which have yet to be released. Governance remains concentrated among 21 DPoS validators.

Transparency is limited — multiple development resources are inaccessible or broken. Key repositories and documentation links such as github.com/libre-chain, contract examples, GitLab API docs, and GitHub issues return either 404 errors or are entirely unavailable, suggesting a lack of public developer access and poor disclosure.

Platform

10/10

Is the chain or bridge robust? Rates consensus security and smart-contract attack surface.

Borrowers are locked to the Libre Delegated‑PoS chain for the life of the loan—a chain whose LIBRE token has fallen ~90 % since 2023. The network relies on a 21‑validator quorum that can upgrade contracts and consensus rules. Vote data from the Libre block‑producer dashboard (libre.antelope.tools snapshot on 24 Jul 2025, ≈ 212 k total votes) show the top‑2 validators control ≈ 56 % and the top‑5 control ≈ 76 % of stake. Most validators are unlicensed private entities with no publicly known founders. Many are affiliated with Libre or EOS. Operational red flags are common: the website of Hotstart (second largest validator) serves a blank, non‑HTTPS page, EOS Sweden (#5) has publicly declared shutdown, and Quantum‑Blok (#6) has dead social‑media links, calling validator availability and governance resilience into question.

Given this concentration, affiliation overlap, and lack of independent attestations, we conservatively treat the validator set as a tightly affiliated group and assign Platform = 10 until Libre publishes verifiable ownership proofs and operational audits.

Oracle

10/10

How is price fetched and signed? Independence, on-chain proofs, refresh speed, circuit breakers.

Closed, provider-controlled oracle with no public methodology; can embed hidden spreads when converting BTC ↔ USDT.

Liquidation Buffer

2/10

How much room and time before liquidation? Combines LTV gap, grace window, and flash-crash guards.

30 pp buffer (50% → 80%). Liquidation threshold is 80% LTV, but enforcement occurs only after a 72-hour grace period. Borrower receives warnings if LTV exceeds 70%.

Rate & Term

2/10

Can interest spike mid-loan? Looks at fixed vs variable APR and funding duration match.

Borrowers choose from fixed-term pools; lenders lock USDT at the same fixed rates.

Transparency

4/10

Can outsiders verify code & solvency? Rewards open-source + live PoR; punishes black boxes.

Libre offers verifiable on‑chain vault addresses and an open reserve‑audit script, but still withholds its MPC bridge code and provides no proof of liabilities.

Loan Currency

7/10

What asset do you borrow? Native-BTC best; fiat stables graded on reserves, audits, censorship risk.

Libre loans pay out in a wrapped version of Tether’s USDT minted on Libre. Redemption requires the CrossLink MPC bridge; if the validator set halts or censures peg‑outs, the token becomes illiquid despite Tether’s backing. On-chain trading depth is minimal: Libre’s only AMM pools hold a very small TVL and daily volume is negligible, with no professional market-makers. This bridge-dependent, thin-liquidity wrapper fits the rubric’s ‘mid-tier or thin-liquidity stable-coin’ tier, so we assign Loan-Currency = 7.

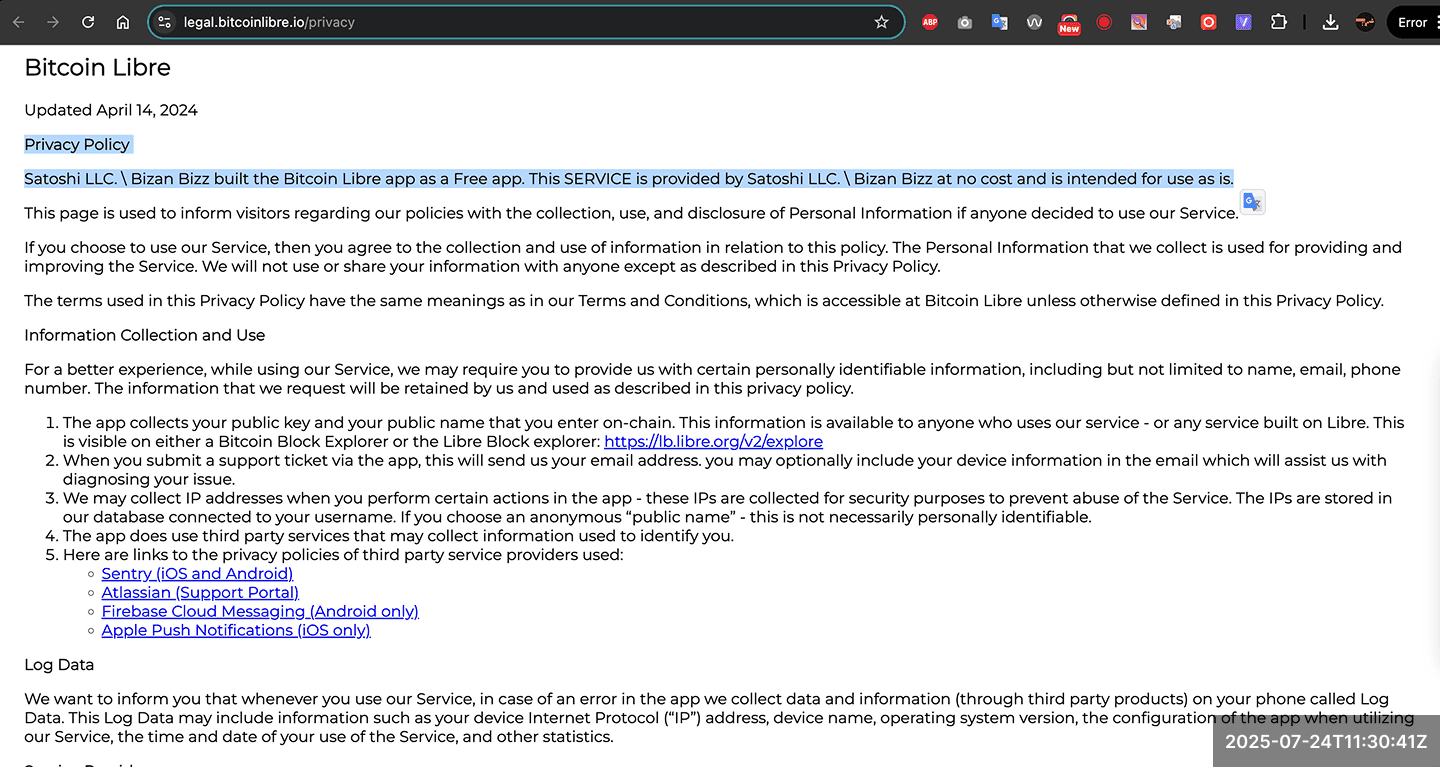

Privacy

2/10

How exposed is your identity? Scores KYC depth, data storage, and breach history.

Minimal personal data collected.

History

4/10

Have they proven themselves? Measures years in production, audit/OSS footprint, and incident track record.

Bitcoin-backed lending launched April 19, 2025.

Jurisdiction

7/10

Which legal system backs you? Rates clarity of licensing, creditor rights, and enforcement.

Legal pages reference “Satoshi LLC / Bizan Bizz” but give no lending license or clear regulatory domicile.